One of my most consistently popular blogs, hands down, is the piece “$350k/year for a Middle-Class Lifestyle.” Without a doubt, I get more web traffic, inquiries, and conversations from that piece of content over anything else on my site.

This piece was published in 2021, and I’ve had time to think about why this piece speaks to people or, at the very least, has them interested to learn more. I get it; the title is somewhat “incendiary,” especially considering Americans’ median household income in 2021 was $70,784. In Massachusetts, we are more fortunate, as one of the wealthier states in the country, with the median household income at $89,026.

It’s not surprising that the claim of $350k per year shocked many people when the average household income was/is significantly less than that. Does this mean the majority of Massachusetts residents are living in poverty? How has this figure increased to $500k annually for a middle-class lifestyle!?

In this follow-up article, I will explain why these figures are not ludicrous. But, more importantly, I will provide some perspective on why lifestyle choices can make a tremendous impact over time. Understand why prioritizing what you care about over what’s expected of you is the greatest gift you can ever give yourself and your family.

Middle-Class Income in Boston – Why Is $500k a Realistic Number?

You may say, “well, I don’t feel financially insolvent, and my family doesn’t make half a million dollars a year.” Of course, not every family is going to have the same needs or goals, but I’m generating these figures based on a family living in the Greater Boston Area, trying to live the same lifestyle that was considered comfortable middle-class living in the previous four/five decades.

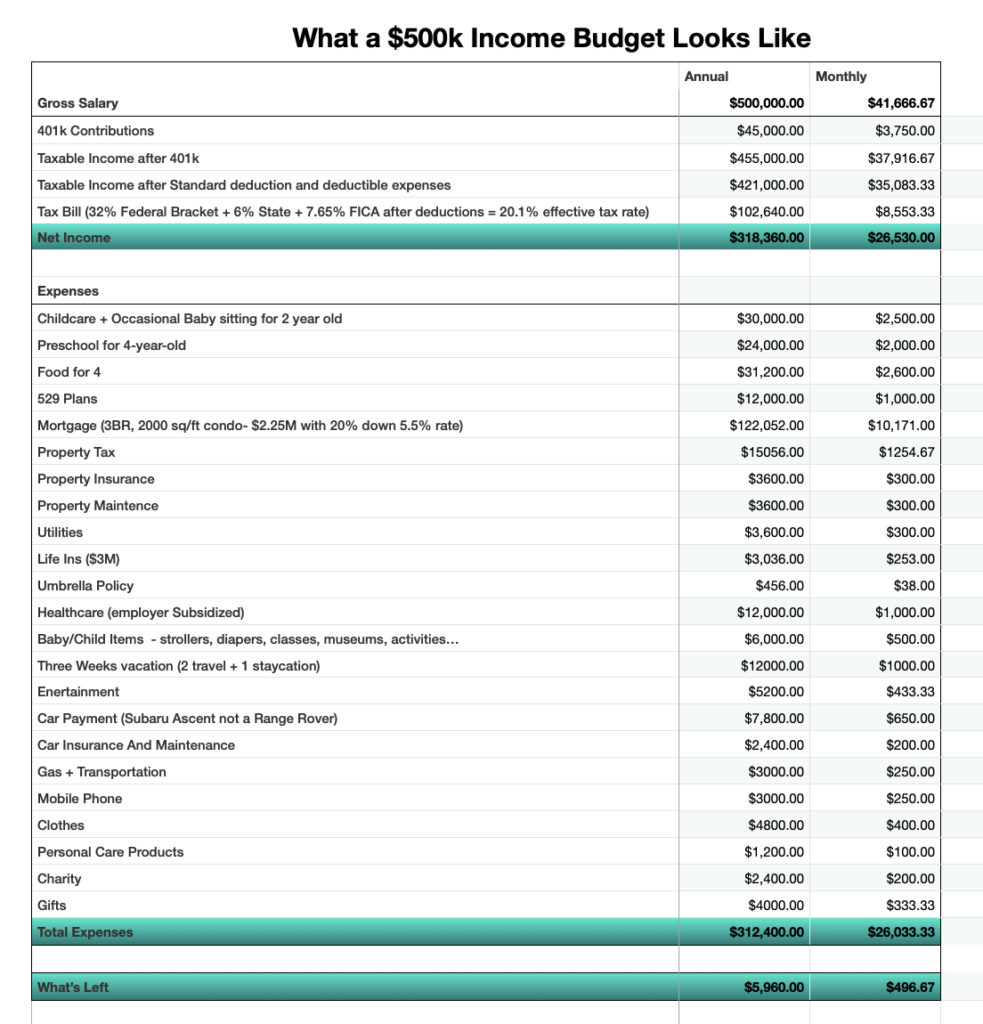

See the chart below:

As you can see, without overindulging in luxury, the average household living in the Greater Boston Area, or any coastal metropolitan area, will be right around the $500k threshold to maintain an “expected” middle-class lifestyle.

Household Income Profiles of Greater Boston

Massachusetts, particularly the Greater Boston Area, is known for its flourishing jobs sectors like healthcare, tech, biotech, finance, government, and higher education. I’ve got clients working in all of those areas and many in the non-profit arena as well.

While it may sound incredible to some that a significant piece of the working population in Massachusetts is making this type of household income, it’s not only common but the standard for living a comfortable life in Greater Boston.

Here are a few examples of young professional households generating income levels of around $500k per year:

- Married doctors, mid-late 30s, working at Brigham and Women/Mass General

- Two corporate-ladder climbers in the shoe industry (Nike, Reebok, New Balance, Converse)

- A 20-year police captain and his partner, a 15-year practicing orthodontist

- Married HR managers, mid-late 30s, working for Merck and Biogen

- 12-year engineer at Raytheon and 16-year manager at Novartis

- Married couple, both trademark attorneys at Barnes & Thornburg LLP

- Associate Director at Partners HealthCare and self-employed dog walker in Beacon Hill

To add more perspective on the types of individuals making 500k per year, JD Davidson, a 20-year-old guard playing for the Boston Celtics, is projected to make 508K during the 2022/2023 season. Players signed to Patriots reserve/practice squads won’t make anything less than 705k yearly.

Middle-Class Income in Boston – Inflation is Real

Inflation is not a new subject in my blog, and I’ve covered it multiple times (see Saving Strategies and Inflation Woes), but the subject matter keeps evolving as the days go on. Some may dismiss inflation as overhyped clickbait at this point, but it is not simply a media-driven event. The culmination of world events (post-pandemic living, supply chain issues, the war in Ukraine, etc.) resulted in 2022 with an average inflation rate of around 8%.

I’ve felt inflation whenever I’d do my weekly grocery shopping at “WholePaycheck” (pardon the dad joke, but I’ve been saying that before being a father) or take the kids out to buy new clothes. It’s funny; at some point in our lives, we think price points are definitive and everlasting. I still think jeans are just $20 per pair, for all time, because that’s what I could buy them for in college. For others stuck further in the past, they think the average monthly mortgage payment is $750.00 per month. In reality, inflation keeps moving along, markets change, more expenses occur as your family grows, and competition increases; it increases just how things go.

Inflation and the Housing Market

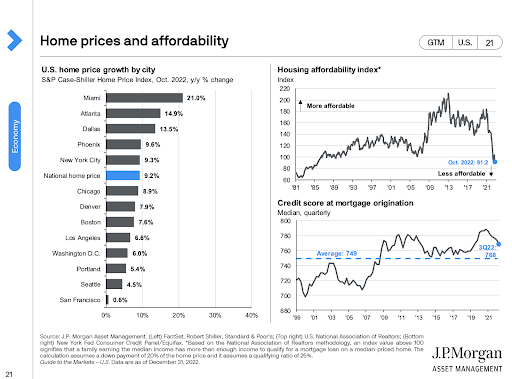

The combination of housing prices still not coming down, a highly competitive buyer’s market, and interest rates at the current levels have made it a difficult place to afford a home, nearly impossible for a family of four unless you make $500k annually. The index for housing affordability has reached levels that we have not seen since the mid-1980s.

Personally, inflation has hit my family the hardest when it comes to housing. We had been looking to upgrade, adding another bedroom and a bigger outdoor space to accommodate our growing family. In 2020-2021 we were being outbid by crazy offers and decided to wait until things calmed down. Interest rates did their job slightly slowing the feeding frenzies but have not yet reduced the prices on the most desirable homes.

Even though it’s only been two years since the $350k for middle-class lifestyle piece was released, I’m confident that the $500k figure is more accurate to what is needed for a comfortable family lifestyle in Boston in 2023.

Perspective, Not Shame

While some people may take this piece as an offensive knock on their financial situation, I assure you it’s not. I’m trying to provide some perspective on how costly it can be to maintain what is expected of many middle-class families in the Boston region today.

I’ve laid out some data and reasoning behind these figures, but this is not to shame anyone into trying to chase the higher paychecks or feel bad about not “keeping up” with their neighbors. I’ve known plenty of people in my life who’ve always chased the bigger paycheck and title and came out on the other end less happy, in more debt, and regretful about the time they didn’t spend with their loved ones. As a family financial planner, I must help people find perspective and set a path to reach their goals and no one else’s.

Owning a 5 million dollar brownstone in the Back Bay may be someone’s passion and goal, but if it doesn’t align with yours, why extend yourself to meet it? Do you like the ocean breeze and lower cost of living found on the North Shore? Why not move there?

If spending more time with your children as they grow up is more important to you than retiring early, then that should be your goal, not working 80+ hours a week to step away at 55! Taking ownership of your goals and reconciling your desired path is step 1 to successfully planning for the future.

If you’re looking for some perspective on your financial situation and goals or would like to contest my opinions in the piece, please reach out – I’d love to start a conversation with you and offer my guidance.