I often reflect on my early years as a young, eager Boston financial planner and try to extract lessons I learned from experiences to see how they’ve helped me grow wiser. I won’t exactly say when, but let’s call it during “Tom Brady’s early career,” I was fresh out of college, working at a well-known financial institution, and tasked with the job that everyone hopes they to do, cold calling prospective clients. Just as they say that everyone should be forced to work in the service industry for some time before passing judgment on a restaurant, I feel that people should also have mandatory cold calling experience before they can cast aspersions onto people who work in sales/finance/business.

As you can imagine, when you’re cold calling, it’s all about working through lots of volume with the hopes of single-digit success rates. It can be nerve-wracking at first, but then you learn where to expect the twists and turns of the conversation to go and how to navigate around them. While I won’t say I miss that type of workday, I will say it taught me a lot about human nature and how to communicate with people in the best way possible.

One of the memories I have from that time in my life is how often people would use the phrase “I’m all set” when they didn’t want to hear about my services or continue the conversation any further. “I’m all set” was almost like the ultimate barrier, nearly impossible to get by, because people who truly believe they’re all set are not looking for a better solution to their needs; they feel they can handle what’s in front of them.

The questions I pose to anyone considering DIY financial planning are: “You may be all set, but are you optimized? And “Is it worth all your free time trying to figure it out?” Let’s explore the notion of being “all set” a little more.

DIY Financial Planning – Are You “All Set” or Optimized?

In the years since my “cold calling boot camp,” I’ve had the blessing of working with people who don’t need to be convinced that family financial planning is a good thing and a way to help ensure that future generations will be accounted for. However, once in a while, I will have a conversation with someone who had once told me they were “all set,” and I hear why their risk vs. reward strategy of DIY financial planning may have been off the mark. It’s not so much that they could not make a plan that worked, but I believe they could have used their time better.

Here are a few outcomes that most people realize after years of DIY financial planning:

- Most regrets come from all the time spent/opportunity cost it took to curate and implement their financial strategies. For example, picture nights of arranging spreadsheets, reading through online forums, trying out different low-cost/ineffectual online subscriptions, etc. Learning financial strategies takes time, lots of time.

- DIY financial planning is often reactionary, not proactive. It’s hard to know whether it’s best to change course, stay on the same heading, or add supplementary aid when you’re siloed. Most people who engage in DIY financial planning consistently reach out to other people and resources, looking for how to react to a situation when they could have potentially been told how to act when a life event happens.

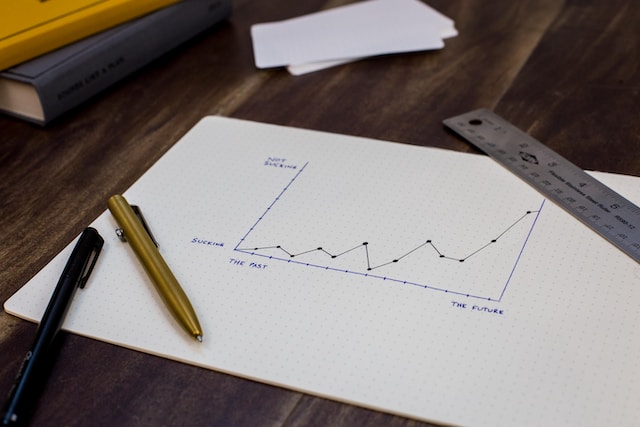

- It’s only after the fact people may learn that while they’ve pieced together a coherent financial plan, it’s not optimized; it could have been better.

Though some may argue that all the effort of DIY financial planning is worth it, what if you could work toward achieving better results with potentially fewer hassles? What if there was a way to streamline your efforts and optimize your outcomes?

In this vein, let me share a real-life story with you. I recently had an enlightening conversation with a seasoned DIY investor who seemed to have it all set. But, after watching a video I had created, they realized that there were minor tweaks they could implement to position themselves better and possibly upgrade their investing outcomes.

Don’t Live With Regrets

I don’t want anyone to read this and think, “I’ve blown it. I’ll live the rest of my life in financial regret.” No, don’t do that. It may be too late to optimize your financial past, but it’s rarely too late to optimize for your financial future. Maybe you can still disinherit the IRS from hundreds of thousands of dollars! Maybe you can still develop an inheritance strategy to help avoid familial unpleasantries down the line! Maybe you can change a few habits and retire a few years earlier!

For all those out there trying to save some money with DIY financial planning, wouldn’t it be nice to have an experienced, knowledgeable, human contact point to be there when doing it yourself doesn’t feel like the optimal choice?

If you’re looking for someone to be there when the noise, conjecture, and questions become too much, please reach out; it’s not too late to start the conversation.