Donating assets or funds to charitable organizations is a way to give back to your community, support organizations with similar values to your own, and leave behind a legacy of generosity & philanthropy. It’s a way that many people feel they can do good while feeling good about their contributions.

But what if we told you that the good doesn’t end there?

What if we told you that donating money could simultaneously support charities and provide your family & loved ones with more money and resources?

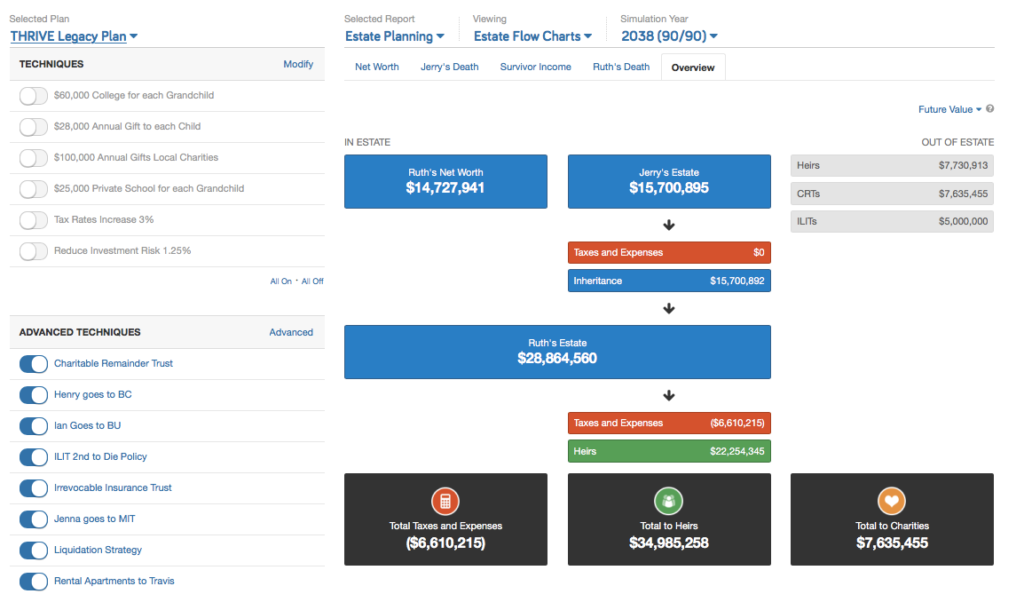

At Thrive Wealth Management, we can help you set up accounts & budgets, and educate you about different trusts that:

- Support charities and organizations that you’re passionate about

- Provide grantors & heirs with increased income

- Guarantee continued donation & support for a specific timeframe

- Provide tax deductions, savings, and exemptions

- Grow your retirement plan and/or assets

- Allow you to give less focus on managing financial assets and more focus on your life

You need someone with experience to help your legacy become a reality. Over the years, Thrive has amassed a large network of CPAs, estate attorneys, and other professional experts in charitable giving. This group of professionals can provide you with connections to comprehensive strategists and allies out there who are as excited about your legacy as we are.

And you will receive much more than a financial advisor with a deep network. We act as your financial advocate, ensuring your wants and needs are at the focus of every meeting, consult, and plan put forth.

We will help you through every stage of the process: discussing your goals, outlining a personalized charitable giving plan, and executing upon it through attorneys and accountants.

By creating your THRIVE Legacy, you can ensure that everyone benefits. Your charities of choice, your family, and yourself can all reap the benefits of your philanthropic giving.

As for our legacy? It’s our goal to help clients redirect $250,000,000 of assets to charities. You can be a part of making a huge difference for your own families and hundreds of other families out there.

Contact us to set up an initial conversation to start planning how to give back to the people and causes that matter the most to you.