Spring is a beautiful time of year. We’re blessed with blossoming flowers, the beautiful pinks and vibrant greens of cherry trees in full bloom, the smells of barbecues outside, and, if lucky enough, three of our Boston sports teams playing in tandem with one another—just a great time of year. It’s also the time of year when kids are graduating from high school and college, which inspired me to write about the big financial decisions when financing our children’s higher education.

College savings accounts and saving strategies are more important than ever to make college an attainable expense for parents to contribute to or pay for. But is it as simple as contributing to a 529 account and calling it a day? Or are there ways to optimize for your children’s future and be less constrained if circumstances change?

College Savings Accounts – My Choices for Entering College

It’s very easy to date yourself when comparing the costs of in-state and private college tuition for undergraduates for kids today. It’s truly astonishing how much some yearly tuition costs today. When I was finishing up my high school days, my parents gave me a choice, and looking back upon it, I see how pure genius it was. The money they had put aside for my college education was not in a 529 plan because they didn’t exist until 1996! So, there was some fluidity to where the assets could be allocated.

My parents said,

“This money can either go directly to a private institution of your choice, or you can choose an in-state school and use the leftover money to set yourself up with a jeep and downpayment on a condo somewhere.”

I chose to attend the University of Connecticut, where I received a great education, had tons of fun, and witnessed some of the greatest basketball the game has produced. I have no regrets about my decision – my college experience was fantastic. I left undergrad with a leg up by avoiding rent, investing in my own property, and having a fun black jeep to drive around Beacon Hill and the Back Bay as my career as a Boston financial planner was in its infancy.

Back to the part about dating yourself, I’m a proud Gen X-er who grew up with the first Nintendo during the dawn of grunge rock. However, I understand that the late 1990s and early 2000s were not the same economy as today. Still, the point is that college saving and spending strategies will differ for each family/young person entering higher education.

College Savings Accounts – What Should Parents and Kids Keep in Mind?

According to the Education Data Initiative, recent data shows that the average cost for an in-state student attending a four-year institution is $26,027 for one year. For students attending a private institution, it’s $55,840 per year living on campus, with $38,768 being tuition and fees. Overall, when including interest and potential loss of income, it’s estimated that a bachelor’s degree can end up costing $500,000 when all is said and done. Woof! For some local examples, Boston College is estimated to average around $83,000 per year when room/board and books are included.

Here are two questions that families and would-be students should have together before committing to one college savings plan or another:

Does your child know what they want to major in, and do they have career aspirations post-college that require more degrees?

Many 18-year-olds sign up for school without any indication of what they want to do in college or post-college. Perhaps they go to college because they’re told it’s the right thing to do, or maybe they like the idea of college life (who wouldn’t!?) However, signing up for debt without understanding your purchase can be ill-advised. I’m not saying that kids are free to figure out what they want to do with their lives while in college, but it may not be worth paying the added expense of private institution tuition if there’s no formed path post-college.

These conversations are great just as your child starts thinking about higher education in their sophomore/junior year of high school.

Do your child’s career goal(s) require certifications in grad programs?

The number to aim for can drastically change whether your young student is looking at a four-year bachelor’s degree or the ten years of schooling required for law or medical degrees. Savings strategies will change early on depending on these factors.

Are 529s The Best Avenue?

529 college savings accounts provide families/students a tax-advantaged way to save, which is why they’re popular. 529 college savings accounts allow contributions to grow tax-free, and withdrawals for qualified education expenses are also tax-free. For those who want a “set it and forget it.” savings plan – 529s are usually the way to go.

However, I tell my clients that 529s are only perfect for some, not all. For some, the tax-free growth is not worth losing control over their asset allocation and asset location, as withdrawals for non-qualified expenses from a 529 may incur taxes and penalties on the earnings. Some families may prefer to manage their own investment portfolio, making adjustments over time for how life unfolds.

Consider diversifying your asset location between a 529 plan and a brokerage account. If you can afford to save enough in the 529 plan to pay for an in-state public university and save extra into a more liquid account that you can use for non-education purposes. Think of it this way: life has all sorts of unforseeables, so diversifying assets can provide more flexibility down the road. Consider saving/planning for in-state tuitions with a 529 plan, and savings beyond that can be diversified into other investment-type accounts, allowing for more fluidity with funds.

All Set Is Not Optimized.

As I like to say, Being “all set” does not mean you’re optimized, and the advice of a family financial planner can make a big difference when it comes to long-term planning for expenses such as college.

I like sharing this analogy with my clients: Think of a field goal post as the spectrum of higher-ed institutions. The left upright is public, and the right post is private. Try to kick it down the middle, and if the child chooses public, they will have funds left over for other goals. If they choose private, they will have to make their first huge financial decision and take out loans.

Quick Example: Saving for College with a Newborn in 2024

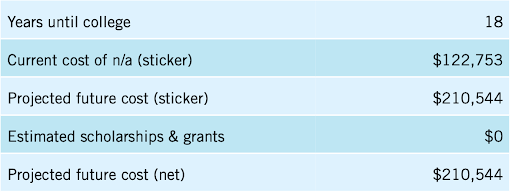

I’ve created a quick model to show what a 529 plan looks like if started today for a newborn expected to attend a public university in 18 years.

This is a hypothetical example and is not representative of any specific investment. Your results may vary.

When saving for a public university in a 529 plan for a newborn, the projected monthly amount is $486 (based on a 3% college inflation and 7% returns on investments). The projected monthly amount for a private university (not shown here) is $1,033.

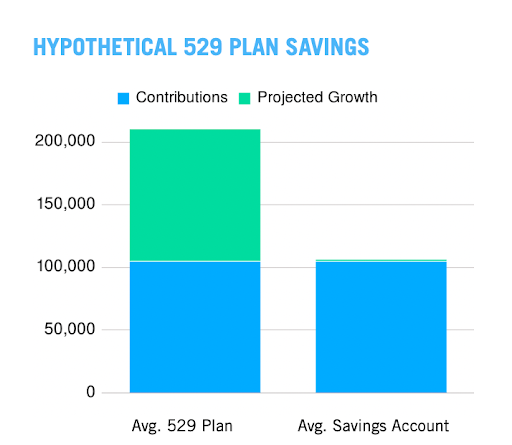

This is a hypothetical example and is not representative of any specific investment. Your results may vary.

The key takeaway is that the 529 plan will have roughly $105k in contributions and $105k in total revenue, equaling over $210k dedicated for college. If used for college, the $105k is taken tax-free. If not used for college, you would owe a 10% penalty and income taxes on the earnings.

Suppose the same amount was saved in a brokerage account; you would pay capital gains taxes on the earnings with no penalties; this may make sense for some, as capital gains taxes are much lower than income taxes.

As you can see, every family will have different circumstances that impact how to best save for college, and going it alone is not the best way to be optimized.

If you have little ones (or high schoolers), it’s never too early to start thinking about college savings strategies, and I’m always delighted to help families stay one step ahead of the curve. Please reach out with any questions.

Prior to investing in a 529 Plan investors should consider whether the investor’s or designated beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state’s qualified tuition program. Withdrawals used for qualified expenses are federally tax free. Tax treatment at the state level may vary. Please consult with your tax advisor before investing.

Asset allocation does not ensure a profit or protect against a loss.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.