A flurry of questions rushes into a young parent’s mind after their child is born. I know this feeling well; I’ve recently been through it for my fourth child! Most would-be parents are fixated on questions like “what does it cost to have a baby?” But, when the child is born, the thoughts drift from what the costs are in the present of having a healthy child and turn to the future. For most parents, two financial “checkboxes” need to be addressed as soon as their child is born; these are life insurance coverage and a saving plan for college.

College, for most parents, is the first significant life investment in their child’s life. Because the anticipated costs are high, it’s an immediate concern, even 18 years before your child steps into their first-year dorm. What will college cost? Can we afford to save for college? Will my child even want to go to college?

As a family financial planner, it’s my job to help parents of all ages consider all avenues and future unknowns of their children(s)’ lives, including how to save for college and not put their eggs in one basket. There’s no doubt that no one child’s path to college or full-time employment is the same, which is why building some level of flexibility into a savings plan is necessary.

Family Finances – What is a 529 Plan?

When thinking about higher-education savings plans and strategies, people are often introduced to the 529 or qualified tuition program. 529 plans are savings vehicles that help finance qualified future education expenses; 529 plans come in two different forms.

The first is a 529 college savings plan: College savings plans allow individuals to contribute to an account to pay a beneficiary’s qualified higher education expenses. The value of a college savings plan depends upon the performance of the investments or investment strategy chosen by the contributor.

The other is the 529 prepaid tuition plan: This plan allows parents, grandparents, or friends to establish an account in the name of a student to “lock-in” the cost of a specified number of academic periods or course units in the future at the current prices. These plans help you protect yourself from college costs inflating faster than your investments grow.

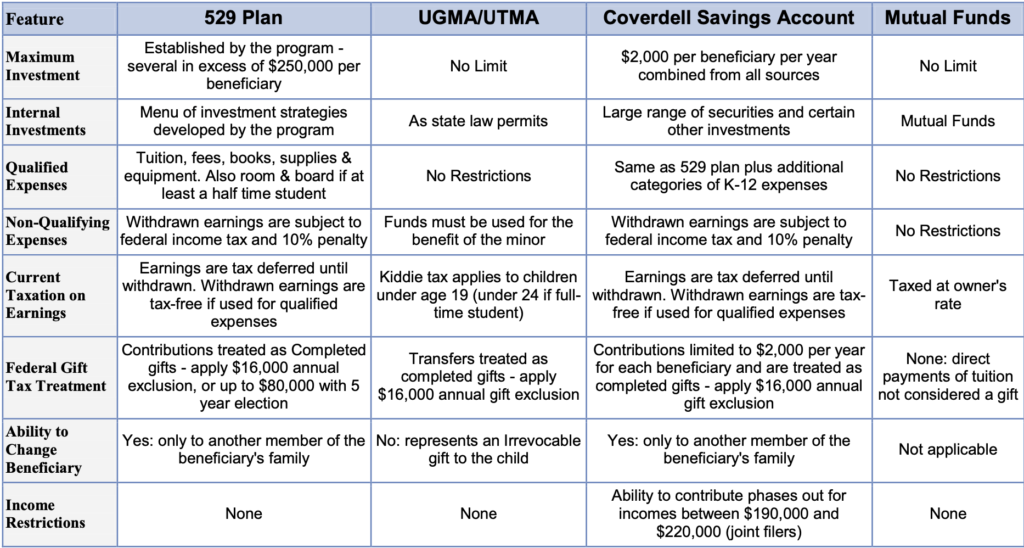

While 529 plans are great for many families, they don’t always allow for as much flexibility as some other savings/investment vehicles that can also be used to help fund a child’s future education or alternative career/life pursuits.

Family Finances – Keeping Options Open

For many of my clients, especially those who’ve just had their first child, college savings strategies can be conceptually tough to grasp, which is why many hold on tightly to the idea of a 529 plan. A state-sponsored college savings plan for higher education expenses sounds like a one-stop solution, but there’s more to the equation.

Other savings vehicles such as mutual funds, trust-free UGMA/UTMA accounts, or Coverdell savings accounts can contribute to your child’s future but may not have some of the barriers, penalties, and contribution limits that a 529 plan does – these variables help contextualize why it’s SO important to consult with a family financial planner regarding college savings plans.

Personally, I love a simple brokerage account where you can buy mutual funds or stocks. These are the most flexible and liquid. While they are not tax-free, you can buy tax-efficient investments and only pay long-term capital gains rates when you withdraw the funds.

If you put all your eggs in one savings basket (the 529 in this example), your money may not be accessible for your child as you need it to be down the road.

For example,

● Your child may choose to enter the workforce directly, skip college, and potentially have a company pay for higher education.

● Tuition structure and costs may be very different in the future.

● Your child may get scholarships, grants, or even a paid full ride.

● Inheritance from a friend or family member may be dedicated to school costs.

*Investing in a 529 Plan outside of your state of domicile may deny you the opportunity to take advantage of favorable in-state tax treatment or incentives.

Family Finances – Setting Up Goal Posts

College costs have significantly outpaced inflation. Most parents have sticker shock when they see where the numbers are today; it can be jaw-dropping to understand the monthly savings needed to attend their alma mater. That is why I show both, so they can feel good about what they are doing and not shame themselves for not doing enough.

According to data compiled by the education-focused non-profit College Board, the average cost of in-state tuition was $1,410.00 per year in 1971; in 2021, that average annual in-state tuition ballooned to $22,690 for in-state students. We can apply the same inflation stats to private institutions as well. In 1971, the average annual tuition for a private college was $2,930 and now sits at $51,690. This data tells us that the average college tuition costs have increased by 4.6x over the past 50 years.

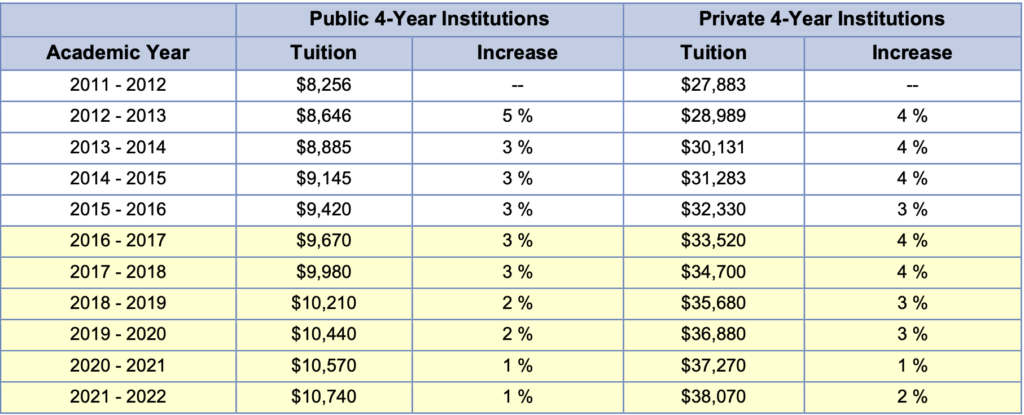

Historically, college expenses have inflated at a much higher rate than inflation but have slowed down some in the past five years. Over the past five years, the total cost of college tuition and fees at a public four-year university has increased an average of 2.12% per year. By the time a child is born today to head into college, they can expect tuition to cost 1.25x what it currently costs. A plan needs to be in place to meet these expected costs, but the plan doesn’t need to be financially debilitating or pigeonhole the options.

There are infinite ways to work towards college savings goals, and just like life, saving situations are fluid and often evolving, so I provide my clients with attainable goals and guidelines that aren’t cemented into one predetermined outcome. I like to use the analogy of setting up savings goal posts that create markers to aim for.

Below you’ll find two links to view PDF reports. Each report gives a financial breakdown of hypothetical savings strategies I could take for my 2-month-old baby girl (Isla) to attend UMASS, a highly-regarded state school, or Boston College, a highly-regarded private institution.

Isla Goes to Boston College

Isla Goes to UMASS

For my family, I am aiming for the left goal post, and saving the remainder in other accounts. But If you’d like to discuss what opportunities, strategies, and saving vehicles are best for you and your family’s finances, please reach out to set up a meeting; I’d be delighted to discuss crafting a plan for your family’s future.

*Prior to investing in a 529 Plan, investors should consider whether the investor’s or designated beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state’s qualified tuition program

Withdrawals used for qualified expenses are federally tax-free.

Tax treatment at the state level may vary.

Please consult with your tax advisor before investing. All investing involves risk including the possible loss of principal. No strategy assures success or protects against loss.