We’ve all heard the adages or sales pitches that claim “if we only skipped that Starbucks coffee twice a week,” we could retire rich at 60 and never have to worry about a thing in our financial futures. Who hasn’t been privy to an insurance pitch or timeshare sales that used these types of statistics?

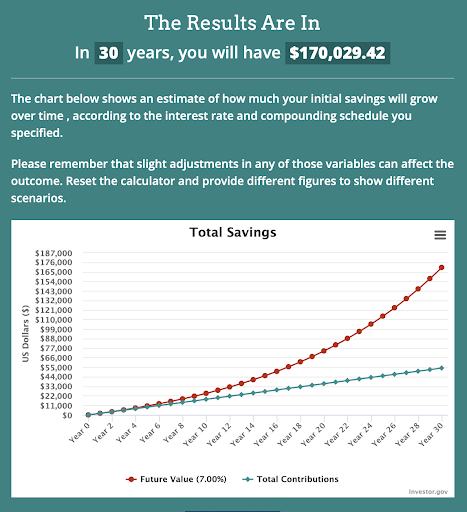

While I can say that there is truth to saving and investing wisely (see chart below), coffee isn’t the issue. Not having a clear perspective and justifying expenses in direct competition with financial goals is the issue, and that’s where I spend much of my time – retraining how people perceive their financial situation.

As a family financial planner, I often have clients, that for no fault of their own, have been ingrained with these types of kitschy “savings techniques.” During our initial meetings, I’ll often get asked if following this type of direction is the best way to start a strong financial foundation and a surefire way to an easy retirement. I want to take a moment and clear the air on the subject. I will provide my perspective on impactful financial planning for families and their futures. I will say this; unforeseen circumstances can throw a huge wrench in the “skip the coffee” planning process, and there are superior ways to set a sound financial foundation that doesn’t break with challenges.

Gaining Some Perspective

First and foremost, my profession is about providing perspective and strategy. There are endless avenues to take with financial planning, and the paths will be different for everyone. However, I have a philosophy that I approach every client with, regardless of wealth or family status, and that’s “don’t sacrifice what you love doing to save.” If you love that Pike’s Place Roast at 8:00 a.m. once a week on Saturday, get it without hesitation. If you love taking the kids to Disney World every few years, do it. If you love kiteboarding and want to go to an annual festival in the Florida Keys, you should do it.

What always ends up costing people more than they could imagine are the unconscious spending habits. The $1100 per month lease on a car that gets driven twice per week. The daily work lunch at fine cafes, the $170 per month fitness plan that is used maybe twice a month. These are not life passions, these are habits of lifestyle that we may accidentally find ourselves entrenched in.

“Twenty years from now you will be more disappointed by the things you didn’t do than by the ones you did do. So throw off the bowlines. Sail away from the safe harbor. Catch the trade winds in your sails. Explore. Dream. Discover.“

-Mark Twain

There are ways to save, have a comprehensive plan, and a plan for the unforeseen, all without sacrificing the things you love. Sound financial strategies aren’t about eliminating things we love doing; it’s about seizing opportunities and creating pathways that don’t interrupt the fulfillment of our lives in the present. You must enjoy the ride. If not, you will train yourself to be miserable. There are many things you won’t enjoy when you are old and rich. I regret not traveling more pre-kids. It looks like I will have to wait at least another ten years before my African safari.

The Unforeseen Happens

What grinds me the most about the “skip the coffee” mentality is that it glosses over real, sound financial planning for a quick anecdote. No matter what joys you skip, the savings made are rarely adequate to contend with the substantial challenges that life can throw at you.

A financial plan is always evolving, rolling with the punches, and most importantly, adapting. Skipping the coffee is a static strategy not equipped to handle drastic changes. I’m not just a family financial planner, but I’m also a family man, expecting my fourth child in a weeks’ time as I write this blog. I forecast and plan for a living, but the circumstances the pandemic has thrown at us took my family and me for a ride, and we’ve made it through by being able to pivot with the circumstances confident in a sound plan.

Pivoting When It’s Needed

My wife and I have two young boys who are 6 and 8 years old, a toddler boy, and another baby GIRL on the way. The ever-evolving situation with COVID has been challenging on our growing family, to say the least. But, there’s a lesson to be learned in adapting to the circumstances.

As my wife is far along in her pregnancy, we wanted to limit her exposure as much as possible, but we also need the two eldest boys to go to school. Since just before the holidays, the three boys have totaled 11 days in school – far from normal. To help normalize the kids’ lives during a very abnormal time, we decided to rent an Airbnb down the road and divide the household. I am staying at the rental with the two boys while my wife stays with her elderly mother and unvaccinated toddler – again limiting exposure as much as possible.

Because we had a solid financial plan in place, I had proactively budgeted time off and funds set aside for these types of situations; we could change our lifestyle to make the best of a very difficult situation. There are events in life we can’t predict happening, but we shouldn’t be forced to sacrifice what we love while things ARE going well- that’s not a good plan. Money cannot buy happiness, but proper planning of the resources you have can go a long way to keep the molehills from turning into mountains.

Every Financial Plan is Different

There’s no “one size fits all” plan for everyone’s financial situation. I wouldn’t be any kind of financial planner if I told you skipping the coffee or your next planned vacation would be the answer to all your financial goals. It’s so important to make the most of the moment we have in the present and enjoy the ride. Life doesn’t function like a quick anecdote, and you shouldn’t be thinking about your financial future based on one.

It’s my goal to help maximize the quality of life for my clients, without sacrificing sound planning for when the unforeseen does happen. So go ahead, enjoy that four-dollar coffee, with sound planning it’s something you don’t have to feel guilty about.

If you found this blog interesting and useful, please read my accompanying article,

“$350k/year for a Middle-Class Lifestyle? Here’s Why, and What You Can do About it”

Please reach out to me to start the conversation and learn how your financial goals don’t have to be built on sacrifice.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.