There are some great and not-so-great things about all the information everyone has access to now. Because of the ubiquity of the internet and all that’s within it, No matter what you’re doing, whether it’s building out a retirement plan or attempting a DIY birdfeeder, there’s a blog, video, webpage, and TikTok clip telling you how to do it.

Humans have become very reductionist when it comes to completing tasks. We want to complete everything as quickly as possible, with little effort, and get the best results. Quite honestly, very little out there can be accomplished this way, and I find it an ever-increasing pillar of my job as a family financial planner to explain that there are costs to trying to do everything yourself.

Is a Financial Advisor Worth It?

I’ve written about the dangers of DIY financial planning before, and what it boils down to is this: you may be all set, but you’re not optimized if you’re not working with a professional. The most eager DIYers can spend countless hours researching strategies and options online, and maybe they’ll end up making mostly the right decisions, but what are the opportunity costs of doing so? How much time could have been saved, and how many more memories could have been made by spending time with the family? Are the results the same as they would have been if a professional had provided the advice, insight, and strategy? There’s a very low likelihood that the value the DIYer ultimately gets by not using a financial advisor is worth the costs.

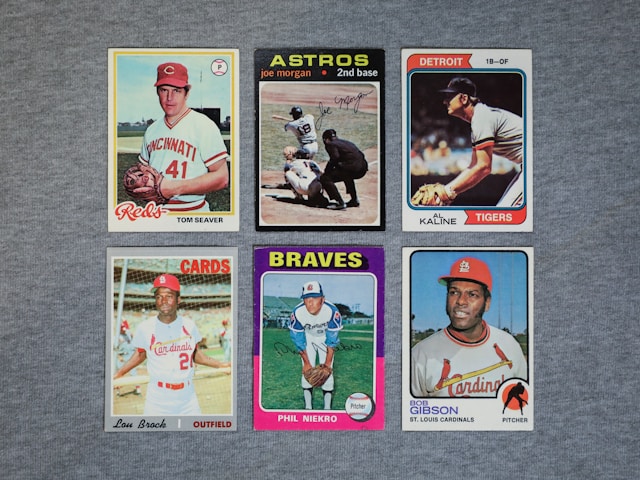

With this article, I wanted to illustrate this point with a dilemma I am going through right now! My boys and I have gotten into baseball/sports card-collecting. It’s been a great time, and we’re having fun doing it. I did it as a kid, and I love that we can all share the experience now. But I find myself in a pickle and need an expert’s help.

What’s in Your Deck?

Questions I have regarding my boys’ collection of new baseball cards and old ones of my own drive me to spend countless hours online, pursuing answers through various websites, forums, chats, and even paid services. I’ve compared card indexing and pricing apps with results that are all over the place. I’ve even been sold fake cards! The whole experience has frustrated me, and I see a little of the irony that I’m doing exactly what I preach against regarding financial planning. The following are just some of the questions I have and want the answers to:

- I need someone to tell me and my boys what cards to buy, just as an advisor would share insights on stock investments for the future.

- I need to know the signs to look for so I don’t get scammed and know who is trustworthy.

- I need to know which Wemby or Anthony Edwards rookie card will be valuable in the future and which ones were overprinted and hold no value.

- Should I be diversifying my card portfolio across multiple sports and even looking into things like Pokemon cards?

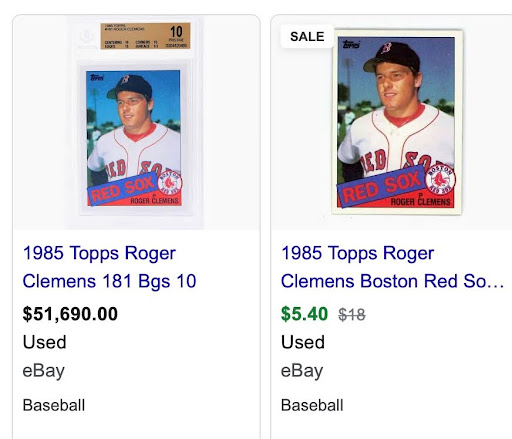

- Am I holding onto my Roger Clemens rookie card because it’s a smart decision, or am I doing it out of stubborn nostalgia, just as one might hold onto a stock they’re attached to?

Now that I’ve realized what’s happening, I have the power to change it; I can seek out a sports card investor, a baseball card advisor, an expert who, no matter what, will always have more insight, knowledge, and information than I do because they dedicate themselves entirely to their craft.

My Experience in the Field

If you go to a collectibles card shop, they will sell you what they have in stock. I wish there were a service that I could pay (gasp!) a commission to sell me the perfect fit for my collection.

“I have $500 to spend, and I am willing to pay 5% for you to ADVISE me which card I should buy.”

Or, as our collection grows, pay a management fee (1%, GASP!) to track and monitor all of the cards and tell me which cards to buy and sell from the universe of available cards.

I can picture an investor who wants a large-cap growth mutual fund spending time filling out forms between research sites, trying to pick the correct fund, and second-guessing themselves the same way I did picking the $30 Wemby rookie card—but the stakes are much higher!

Is a Financial Advisor Worth It? – Trust the Experts

When you go to a restaurant, you trust the sommelier to pick the right wine for your meal. When you go to the gym, you trust a personal trainer to put you on the right track for the best results. When selling or buying your home, you trust a broker to handle all the logistics and legal requirements of the transaction. Experts exist because people need them.

If someone asks, “Is a financial advisor worth it?” I try not to reply with a cynical and terse reply because that’s not who I am or wish to be. But, just as I need the help of a sports card advisor for countless reasons, most people saving to own a home, send their kids to college, pick out a Roth IRA plan, or get ahead of legacy planning need the help of a financial advisor. No matter how much time they spend (and potentially waste) going the route, the odds are stacked against them, and it will be worth it in the end.

Please contact me with any questions you may have and learn how I can help you optimize your financial strategies to best meet your future goals. I’m also happy to talk shop about baseball cards too!