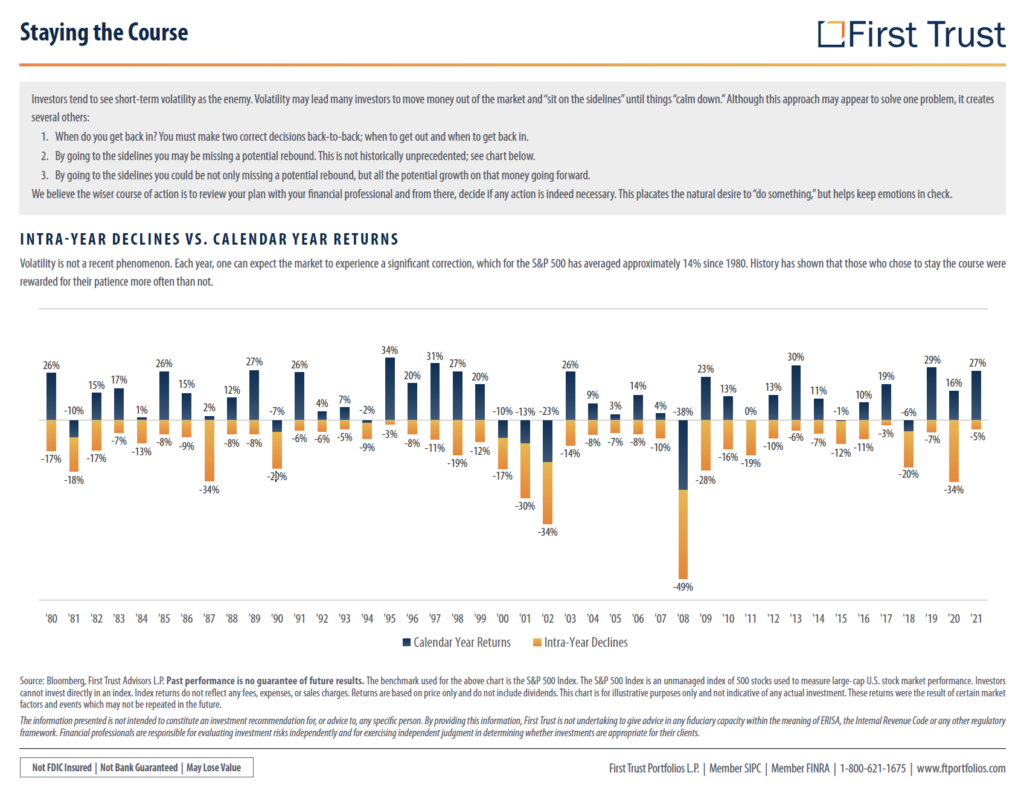

History has proven investors who remain consistent with their financial plans will more often be rewarded for their patience, than those that are not. Every year we expect the market to experience a significant correction and market volatility is nothing new.

- The S&P 500 Index has corrected 13.0% so far in 2022. The average year (since 1980) has corrected by 14.0%.

- Since 1980, 21 years have corrected at least 10% at one point during the year, and 12 managed to come back to positive. In fact, those 12 finished the year up 17.0% on average, so large reversals are possible.

- This year is a midterm year, which historically is more volatile, with more than a 17% correction on average. The good news is stocks are up more than 30% a year off those lows.

- One worry is midterm years tend to find their ultimate bottom later in the year (August 14). Also, this quarter and next are two of the weaker quarters in the four-year presidential cycle.

- Lastly, remember this bull market was the quickest to ever double off the lows; in fact, it is still one of the best ever at this point in its life. Some consolidation and potential weakness are perfectly normal as the bull catches his breath.

Seeing a significant dip in your investments makes it tempting to panic and move your money out of the market to reinvest when things “calm down.”

BUT… you’ll miss out on:

1️⃣ a potential rebound period (see the chart below).

2️⃣ all the potential growth going forward!

When it comes to investing… Stay 👏 The 👏 Course! 👏

As a family financial planner with decades of experience, I consistently have to remind clients that jumping from one impulse to the other is not a sustainable investment strategy, and I’m always available to help people stay on course.

Click the link to get in touch!