When I last brought up the mega backdoor Roth IRAs ( Nov 2021) and the opportunities these tax strategies provide wealthier individuals, there was much political debate on whether or not the strategies to avoid taxes should still be allowed. Currently, Congress is still debating whether to eliminate backdoor and mega backdoor Roth IRAs, if they can. This controversy has sparked debate over the relevancy of these tax strategies and whether to implement them in the future.

As of now, decisions are still being made over backdoor and mega backdoor Roth IRAs. Overall, Congress believes that more good will come out of eliminating these tax strategies than not – they see it as an opportunity to focus on social programs and tax the rich.

The most recent update to this debate comes with the Build Back Better Legislation, a collaborative effort between President Biden and Congress to eliminate backdoor and mega backdoor Roth IRAs. To help you better understand what the Build Back Better Legislation would mean for the mega backdoor Roth IRA, I’ve outlined the intended changes below.

The Build Back Better Legislation

The Build Back Better Legislation has already been passed by the House and drafted by the Senate. Other decisions come with this bill that Congress has yet to deliberate. But, Congress definitively agrees that eliminating backdoor and mega backdoor Roth IRAs should be a significant portion of the bill. If the bill passes, individuals can still make non-Roth after-tax contributions. However, they can’t convert those non-Roth after-tax contributions to Roth. If the bill is passed, the following tax strategies will be banned:

- Converting after-tax money from a traditional IRA to a Roth IRA

- Converting after-tax money in an employer plan to the Roth account within the plan

- Rolling over after-tax contributions from an employer plan to a Roth IRA

Due to disagreements regarding the bill excluding backdoor Roths and mega backdoor Roths, President Biden and Congress have decided to hold off on its approval until sometime in 2022. With that in mind, it’s best to expect final decisions regarding backdoor and mega backdoor Roth in 2022 or 2023. But, what are the possible outcomes, and what will it mean to you in the next year or so? Here are some of the possible scenarios (or outcomes):

- The new law will not pass, and will not be included in future bills.

If no one can agree and we reach an impasse with the legislation, it would be fine to proceed to complete your backdoor Roth and mega backdoor Roth as you normally would.

- The new law will pass and go into effect on 1/1/2023

Follow the same procedure as you would if the law doesn’t go into effect. You’ll have to be aware as the year proceeds along and complete your Roth before the end of 2022.

- If the new laws go into effect immediately (early 2022)

People who completed their backdoor and mega backdoor Roth before the law is passed might not be affected, but everyone else would be impacted by the bill. In other words, it’s best to get it done as soon as possible, even if the law may not pass in 2022.

- The law passes and rules are rolled back to start on 1/1/22

This last scenario is the only one that would affect business as usual and force some change. It is the worst-case scenario, but if it happened, they would have to let people who already did a backdoor conversion reverse it without penalty. I am currently advising my clients to keep on investing and converting through the backdoor.

Being Steadfast in Strategy, Not Reactionary in Panic.

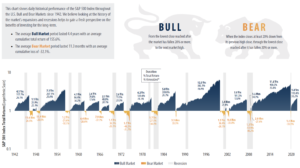

Needles to say, the situation is fluid with backdoor IRAs and mega backdoor IRAs. When the spotlight is on the tax strategies, the conversations in the political sphere draw lots of attention, but then it’s battened down by a delayed vote or legislation that doesn’t fully pass. I will continuously revisit the subject to provide key updates when and if they happen.

As I have learned over my years as a family financial planner, it’s not beneficial to get whirled up and pivot strategies with the latest news cycle. It’s much better to have sound guidance and strategies that account for the unseen changes in the economic and political spheres.

Please reach out and book a call with me to learn more about financial planning strategies.

If you have enjoyed reading this article, please see the following blogs too:

Mega Backdoor Roth IRA – A Brief Rundown

Retirement Age in Massachusetts – When Can You Expect to Retire in The Bay State?

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.