Young professionals face unique financial challenges that call for creative financial solutions to help build a financial foundation.

Social Security is being washed away. Education and living costs continue to rise. Debt and increasing costs are pushing off traditional goals such as homeownership and family plans.

As a millennial or Gen Z, you have a huge advantage when it comes to financial planning: time. With smart money management, budget savviness, and investment knowledge, your financial goals can be well within reach.

Unfortunately, many advisory firms focus specifically on asset management versus financial planning, which excludes many young people still accumulating wealth. Thrive Wealth Strategies has a program that specifically services young professionals.

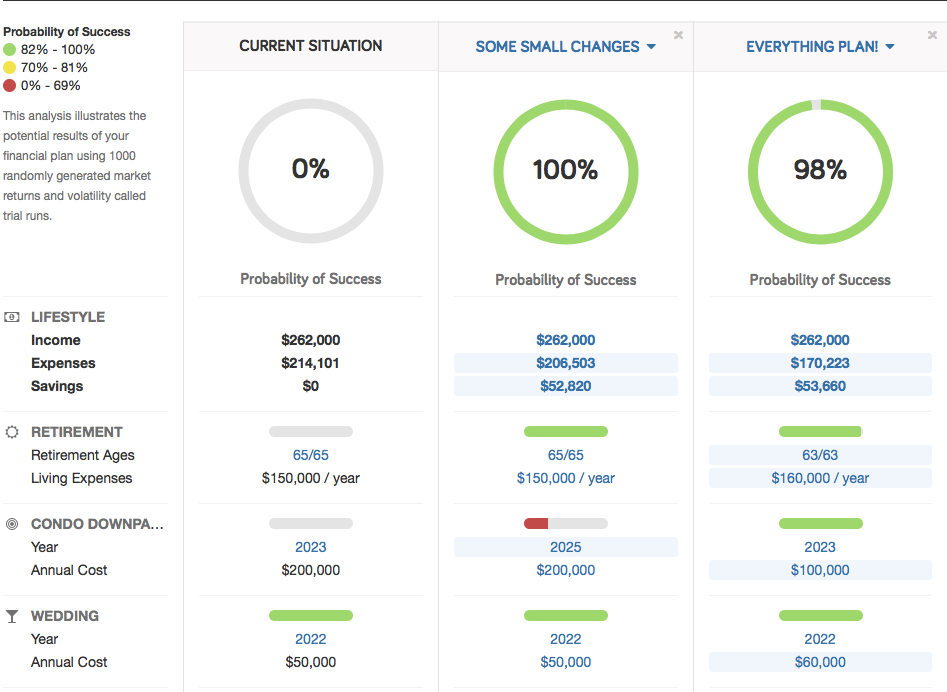

Through a series of meetings, ranging from budgeting basics to credit score to estate planning, young professionals can chart the right path forward. Financial stress is real. We help reduce that by creating a spending and savings plan, developing a 401k strategy, seeking to maximize your benefits, and more.

Building Financial Foundations

Remember: time is on your side. Thrive Wealth Strategies can help set you up for financial independence in the short term and help build a financial foundation for a lifetime to come.