A Roth conversion transfers your traditional retirement accounts (IRA, SEP, or SIMPLE IRA) into a Roth account. Congress is looking at banning backdoor Roth and mega backdoor Roth conversions, which is why this is a crucial and critical discussion point with your financial advisor.

Consider the following questions:

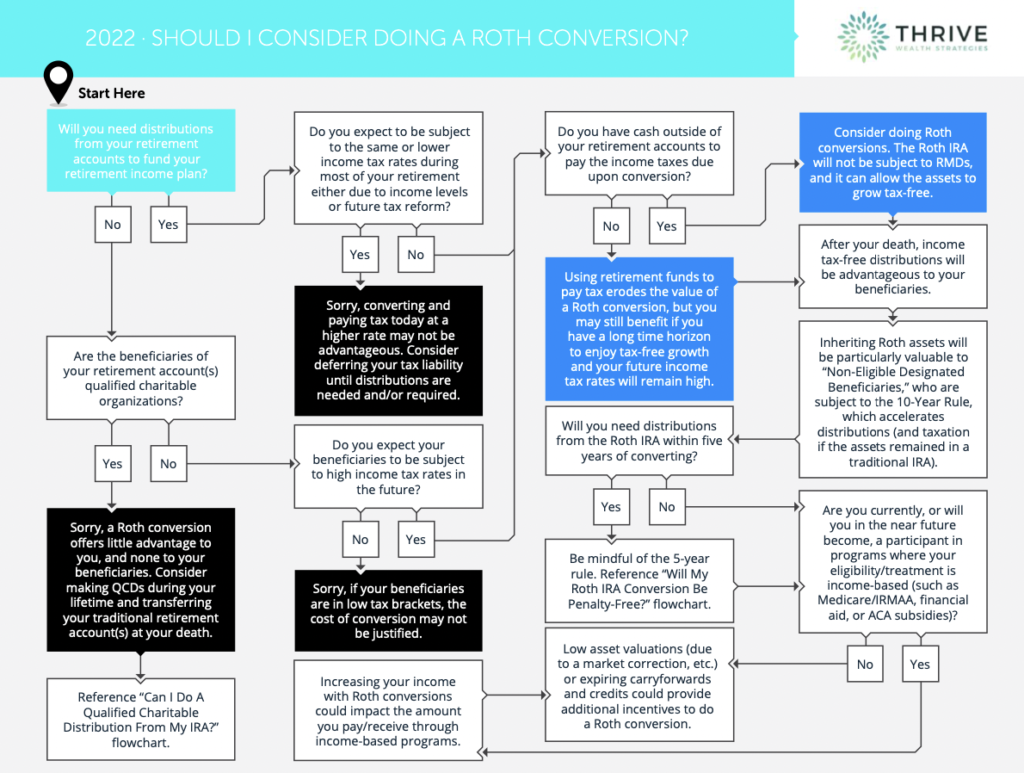

🤔 Will you need distributions from your retirement accounts to fund your retirement income plan?

🤔 Do you have cash outside your retirement accounts to pay income taxes?

🤔 Do you expect your beneficiaries to be subject to high-income tax rates in the future?

Still not sure if a Roth conversion is right for you? I put together a handy flow chart to help you determine if a conversion is an intelligent move for your situation.

Click the Link to View My Full Roth Conversion Flow Chart

As a family financial planner, I help my clients navigate questions like these and choose the path that makes the most sense for their financial goals.

Please contact me with any questions