Today, the definition of the middle class is in constant fluctuation and debate. Is the middle class disappearing? Is a middle-class lifestyle today different from what our understanding of it was for the past 50-60 years? Is today’s middle class yesterday’s lower middle class? What is a middle-class income?

Politicians will argue endlessly about what the middle class is, what it needs, and how they can revive it. I’m not going to inundate you with differing opinions on the middle class, but I would like to share a quick “class barometer” that I heard growing up. This question used to be the determining factor whether or not you were considered middle class:

Can you afford to take your family to Disney World every three or four years?

Well, I think we can agree that as fun as that question is, it probably doesn’t account for all factors concerning the requirements to be considered middle class. So, for all intentions and purposes of this article, we’ll examine the Pew Research Center’s definition of the middle class:

- Middle class, or middle-income households, are those with incomes that are two-thirds to double the median household income.

However, the definition of “middle class” is a bit more complicated than Pew Research Center’s simplified version. The cost of living and average household income varies greatly from state to state. Thus, each state has different criteria for what qualifies as middle class.

For example, to be able to afford what was once considered a middle-class lifestyle in Boston, a household must make at least $350,000 per year. On the other hand, a three-person household in Jackson, Tennessee bringing in $45,000 before tax per year, is considered middle class.

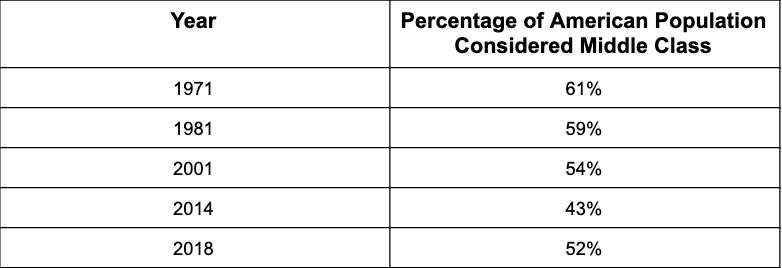

Despite these discrepancies, the middle class across the entire country has changed dramatically over the years and continues to do so. But, largely due to wages being stagnant for decades, the middle class is shrinking.

According to Pew Research Center, the most recent study of 2018 shows that the slim majority of the American population makes up the middle class. However, despite this slight increase, experts anticipate the population percentage to continue to decline rapidly.

I had a conversation with my hardest working client, who grew up middle class and now owns a blue-collar business he started at 18. He owns commercial properties and is clearly affluent. I mentioned that the middle and lower classes have much more to worry about with the imminent inflation than him. He asked seriously, “Am I, upper class?” Everyone pictures themselves as middle, even if only 40-50% of Americans are currently in the middle class.

The table below illustrates the changes over the last several decades:

Figure out exactly where you stand in your area by using Pew Research Center’s income calculator.

Learn How a Family Financial Planner Can Help You Build

a Stable Foundation for the Future

Entering or Staying in the Middle Class

With the changes in America’s middle class, it is clear that both the lower-income bracket and the upper-income bracket are both growing. The lower-income bracket is growing at a slightly faster rate, but a middle class family can move up into the next income bracket with proper planning, knowledge, and guidance.

Most Americans are looking to increase their class standings or, at the least, be comfortable where they stand financially. One of the first steps to building stronger financial foundations is to consult with a financial advisor and get set on the right path.

Here are some tips that can help you begin to envision how you can feel more sure-footed in your financial present and future.

- Stop Shaming Yourself

It’s all too easy to fall into the trap of not feeling like you are doing enough to build your finances. But, unfortunately, there are stages of life that are very expensive. Some examples would be the baby and toddler years (when you are not just paying for childcare or preschool, but accumulating all this stuff you think you need.) Or when sending a child off to college, or even when you’re buying your first house.

You do not need to feel obligated to take on a second job to care for your family and save a percentage of your income. If necessary, you can save a bit less to ensure that your child’s needs are met. This may be the only time a financial advisor tells you that it is okay to save less. It is okay to take a step back from your savings goals temporarily.

Have an honest conversation with yourself and manage your priorities. You do not need to shame yourself into improving your financial situation.

- Add a Second Stream of Passive Income

Finding a second stream of passive income can help greatly with long-term financial goals. For example, instead of buying a single unit apartment or condo, look for a duplex that you could rent out, creating a stream of passive income as a landlord while paying off your mortgage and having a place to live.

Although I love the idea of earning extra income, I truly believe that most long-term side hustles are successful because they are: fun and enjoyable, fulfill a larger mission or purpose in life. It’s best if side hustles provide a good service to others, generate creative outlets, lead to unexpected cool experiences, and develop skills you didn’t know you had. If it’s something you enjoy, the passive income will not feel like work or a new responsibility to deal with.

- Give Up on the “Middle-Class Lifestyle”

You do not have to make expensive purchases to impress others and show off your wealth. You are under no obligation to “keep up with the Joneses.” There are no rules as to how you live your life. Live how you want and don’t prescribe to any guidance that isn’t in your best interest or your family’s.

- Move Somewhere Financially Comfortable

As previously mentioned, the cost of living varies from state to state and even from city to city. Moving to a location with a more affordable cost of living is a perfectly respectable decision. More and more young parents are doing this today to stretch their income further. I moved out of downtown Boston to the North Shore to own a house and save more income for my family, lifestyle changes happen, and it’s not a bad thing.

- Stay on Top of Your Finances

When I say this, I’m not telling you to be obsessive about every penny spent, but be mindful of unconscious spending habits and curb them where you can. It’s remarkable how much this simple strategy can help.

Learn more about Boston wealth strategies and how a fee-only financial advisor can help you get on a secure path and build financial foundations.

Stay tuned to our blog for more articles on our continuing series on middle-class income in America.